Insurance Premium Funding

Smooth out cash flow spent on insurance premiums

Enquire onlineInsurance Premium Funding enables your clients to pay their annual insurance premiums with flexible repayments allowing working capital to stay in their businesses.

At BOQ Finance we understand that your clients’ annual insurance premiums can have a real impact on their cash flow. Our experienced team takes the time to understand your clients’ cash flow needs, providing them with most suitable premium funding solution.

Cash flow that would normally be tied up in insurance premiums can be released and invested back into your clients’ businesses, while also offering them the following benefits:

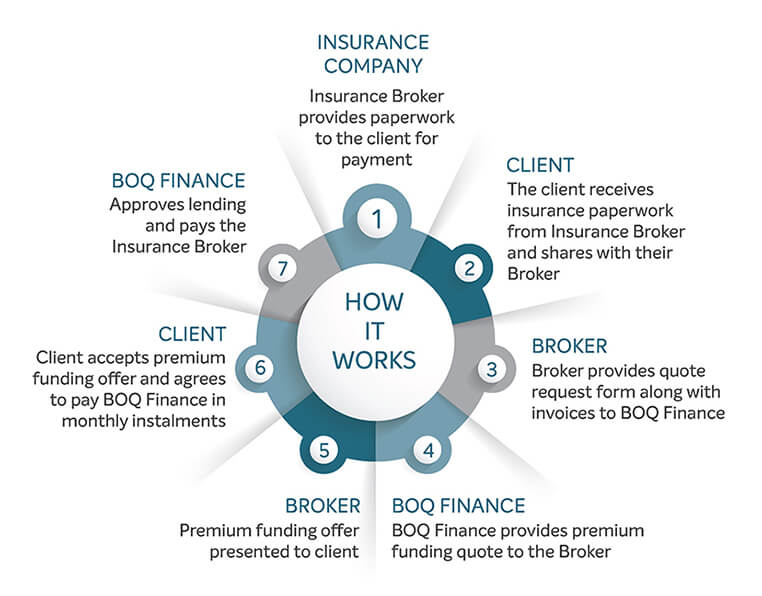

A simple and effective process between insurance brokers and BOQ Finance, provides clients with a more affordable way to pay their annual insurance premiums.